All about Payday Loan

Wiki Article

Payday Loan - An Overview

Table of ContentsExcitement About LoansThe Best Strategy To Use For Payday LoanThe Basic Principles Of Quick Payday Loans Of 2022 How Payday Loan can Save You Time, Stress, and Money.

For a car loan of $100+, 1 month for each and every multiple of $20 of cash breakthrough. Differs commonly depending upon finance type and also amount. Purchase cost can't go beyond $1 for every $5 of cash loan. Acquisition charge can't exceed one-tenth of cash loan quantity. Purchase charges are separate from rate of interest. Utah None Varies depending upon rollover choice.

Wisconsin None n/a No limitation on passion billed prior to maturity date of payday advance loan. If not paid by maturity day, might bill rate of interest at max of 2. 75% monthly. This changes if you have even more than 1 payday advance loan. Can not offer payday financing if consumer has greater than $1,500 or 35% of gross month-to-month income in cash advance finances.

This chart is current since August 2019. For proposed costs and one of the most current updates to these fees as well as regulations, click here. To download and install a PDF variation of this table, click here (Loans). To avoid predative car loans such as cash advance and also automobile title lendings, there are generally two tracks you can take: The "I need cash currently" options to aggressive financings.

Unknown Facts About Payday Loans

The catch with this payday advance choice is you typically have to be a member of the cooperative credit union for at the very least one month before getting this short term finance. To obtain accessibility to a PAL, talk with your regional lending institution or financial institution. While you may not receive a financing on your very own if you have inadequate or no credit report, with a cosigner, you could access to a personal funding with far better rate of interest and build your own credit report while you're at it.Preferably, a cosigner should be somebody that has fantastic credit score. Simply bear in mind, if you don't pay back the funding, you would certainly not just place the financial burden on your cosigner, you can additionally damage their credit scores. (See even more concerning how co-signers impact your credit report.) If you go this course, make certain you will certainly be able to pay off the loan as concurred.

This way, if you do experience monetary difficulty, such as task loss, medical costs, unanticipated car repair work, etc, you'll be able to either borrow the cash with a premium quality loan item or bank card, or have actually the cash conserved to cover what you require. Quick Payday Loan. Below are some techniques you can start today to help avoid predacious lendings in the future.

All About Payday Loans

Several on the internet banks currently offer rather high APYs at least compared to the national average and also do not call for a minimal down payment to open up a savings account. You can start a cost savings account with just a few bucks. Some financial institutions, like Ally, provide an APY of over 2%, while some bigger national financial institutions like Financial institution of America offer closer to 0.When you obtain a savings account with a higher APY, you can grow the cash you do have in your savings quicker. Other than possibly capturing you in a debt cycle, several payday advances (most?) do not assist you build credit report even if you pay them off, given that they do not report your payment history to the debt bureaus.

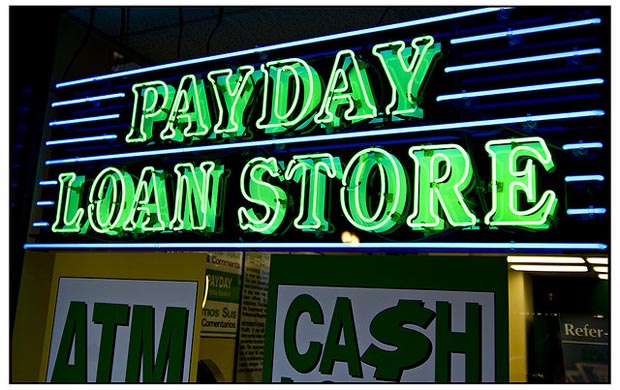

When you're pinched for money, it can be appealing to submit a five-minute application to obtain the cash you require with a payday advance loan. However the quickest way isn't always the most effective means, and you might wind up paying for that single "payday" finance for many years to come. Prior to visiting the closest cash advance store, be certain to take some time to look over your other options.

All content at Self is created by experienced factors in the money market and also examined by a certified individual(s).

Some Ideas on Quick Payday Loan You Should Know

The lendings are for tiny quantities, as well as several states set a restriction on payday advance loan dimension. $500 is a typical loan restriction although limitations vary above as well as below this quantity. A payday financing is typically settled in a single payment on the borrower's next payday, or when revenue is gotten from one more resource such as a pension plan or Social Protection.

Some states do not have cash advance financing since these lendings are not allowed by the state's regulation or because cash advance lenders have decided not do to company at the passion rate and also costs allowed in those states. In states that do permit or manage cash advance financing, you may be able to find even more info from your state regulatory authority or state attorney general .

Those securities include a cap of 36 percent on the Military Yearly Percentage Price (MAPR) along with other limitations on what loan providers can charge for cash advance and also Loans other customer loans. Contact your regional Court Advocate General's (BUZZ) workplace for more information concerning providing restrictions. You can use the buzz Legal Aid Office locator to discover aid.

Report this wiki page